Taxpayers have been given six weeks to provide their feedback on the ‘huge challenge’ of finding £108million to balance Kent County Council’s budget, the authority announced on Thursday [October 13].

Proposals indicate that a mixture of tax rises and funding cuts will be needed to plug the black hole, with one Cabinet member warning further savings will need to be found for the ‘foreseeable future’.

In their budget report, the council [KCC] states it has identified ‘savings’ worth £75million for the next financial year, which comes on top of half a billion pounds’ worth of savings made since 2010 as central government funding has dried up.

These cuts are expected to result in up to 400 job losses spread across all of the county’s services, except in schools.

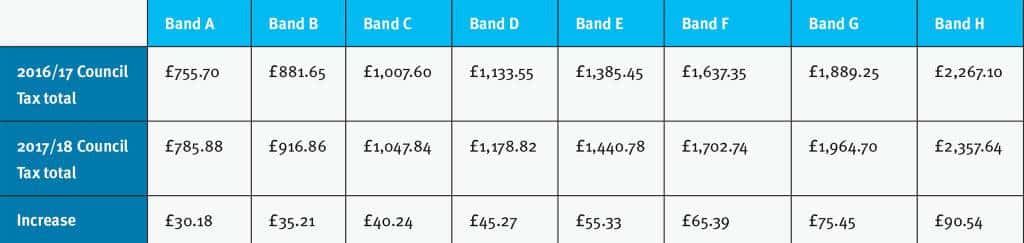

Most of the remainder is to come from a 1.99 per cent rise in council tax and the introduction of a 2 per cent ‘social care precept’ – made possible by government legislation aimed at softening the blow of local authority cuts – while approximately £5million in savings are yet to be identified.

If both increases are accepted, it would mean the KCC precept on a Band C property increasing by £40 from £1,007.60 to £1,047.84.

Announcing the beginning of the consultation, KCC Leader Paul Carter said the authority had been able to find savings through ‘sensible’ management, adding: “The government has placed an enormous challenge on us by imposing on local government some of the biggest cuts compared to other parts of the public sector.

“With forward planning, and facing the challenge early on, we are now in a better position than most.

“We totally understand that some transformational plans take many years to implement. We are forward-thinking, have made intelligent commissioning decisions and have the situation in hand.

“Despite these huge challenges, we are determined to continue to make Kent a great place to live and work, seeing the population grow and attracting new businesses.”

The council’s total net expenditure for 2016-17 is £1.8billion, the vast majority of which is spent on direct services to the public.

The six-week consultation has been timed to conclude before the government’s autumn budget statement at the end of November.

John Simmonds, KCC’s Deputy Leader and Cabinet Member for Finance, said: “We have been under pressure for several years, and yet we have continued to prioritise our universal frontline services as well as protecting the most vulnerable in our society.

“We have to launch this campaign now, based on our best estimates, so that we are ready to get the full benefit in 2017-18.

“The council will still need to set its final budget and council tax in February, but this new approach – with a full budget update to county council in October – enables us to get the ball rolling earlier and prompt a wider debate with residents, clients and service providers.

“We are anticipating that this trend of additional spending demands and insufficient funding will continue for the foreseeable future, and therefore further significant savings will continue to need to be found until 2019-20 at the earliest.

“The decisions we make in our budget will affect everyone in Kent. That’s why we want to engage with as many residents as possible and we feel that online, through the council’s website, is the most effective medium for the vast majority.

“There will be other ways for people without online access to engage.”

WHAT DOES KCC SPEND ITS BUDGET ON?

For the Tunbridge Wells borough council tax payer, 72p in the pound goes to KCC, while just 10p in every pound is kept by the borough. The remainder goes to Kent Police (10p), Kent Fire and Rescue (5p) and parishes (3p).

Here’s some of the things KCC is responsible for:

- Supporting 5,506 people with nursing and residential care that best meets their needs

- 7,828 people receiving a homecare support service to enable them to stay in their homes

- Providing a social care service for 35,440 adults last year

- 85 children’s centres, working with 65,000 youngsters

- About 2,300 children in care, including more than 800 young unaccompanied asylum seekers

- 24,300 young person’s travel passes

- 16.9million free bus journeys for the elderly and disabled

- Supporting 5,000 adults with substance misuse issues

- 70 community wardens

- 5.6 million visits to our libraries

- 6,847km of public roads

- 9 country parks, attracting 1.6 million visits

PROPOSED KCC COUNCIL TAX RATES 2017/18

YOUR SAY: If you wish to take part in the public consultation, visit: http://consultations.kent.gov.uk/consult.ti/BudgetConsultation2017. Or to request the form in alternative formats, email: alternativeformats@kent.gov.uk or call 03000 421553. The closing date for responses is November 27, 2016

Where are savings being found? Examples of the savings being made can be seen below:

The Education and Young People’s Directorate is looking at innovative ways of generating additional income of £1.9million in 2017-18 through the creation of support packages for schools and academies.

In Adult Social Care, KCC has identified savings of £13.3million through transformation, although the increase in demand for, and costs of, care services will mean the extra costs will outweigh even those savings.

KCC also anticipates saving about £2million from its home-to-school transport budget for special education needs pupils through smarter route organisation and intelligent procurement.

The £40million project to convert all of KCC’s 118,000 streetlights to LED technology will deliver in excess of £5.2million in savings on energy bills annually, once complete (as well as reducing KCC’s carbon footprint).

Although the cost of waste disposal per tonne continues to increase, the cost of recycling and handling waste in Kent is lower than four years ago as the county has reduced its landfill waste from 19 per cent in 2013 to below 2 per cent -well ahead of the national target of 5 per cent by 2020.

As central government continues to pull the plug on funding, what else is putting pressure on KCC’s budget?

Additional pressures come from a combination of factors: Rising prices; the demand of supporting a growing population of elderly people; and particularly the introduction of the National Living Wage falling on providers.

By making changes to help cope with the increasing number of elderly residents requiring care, and the increasing complexity of many clients’ needs, the council is seeking to reduce costs by transforming service delivery and investing in support and preventative services.