Couples and individuals struggling to get on the local housing ladder are being forced to pay the highest rental costs in the county while they try and save for a deposit on their own home. And it’s an uphill battle.

One Tunbridge Wells resident has described being trapped in a ‘never-ending cycle’ of rent increases, meaning she has no money left to save for a deposit.

It is a common problem across the UK, with renting among those aged 21-25 overtaking home ownership in 2004. For those aged 26-30 the tipping point was in 2011.

In the meantime, the number of young adults living with their parents reached 3.3 million last year, as the proportion of disposal income being swallowed up by rents rocketed, hitting 28 per cent in the South East.

And it is particularly acute in areas deemed affluent, such as Tunbridge Wells.

The town itself has some of the highest rents in the county according to data released by the Valuation Office Agency.

Figures show that the average private sector rent across all housing sizes in Tunbridge Wells in 2014/15 was £994 per month.

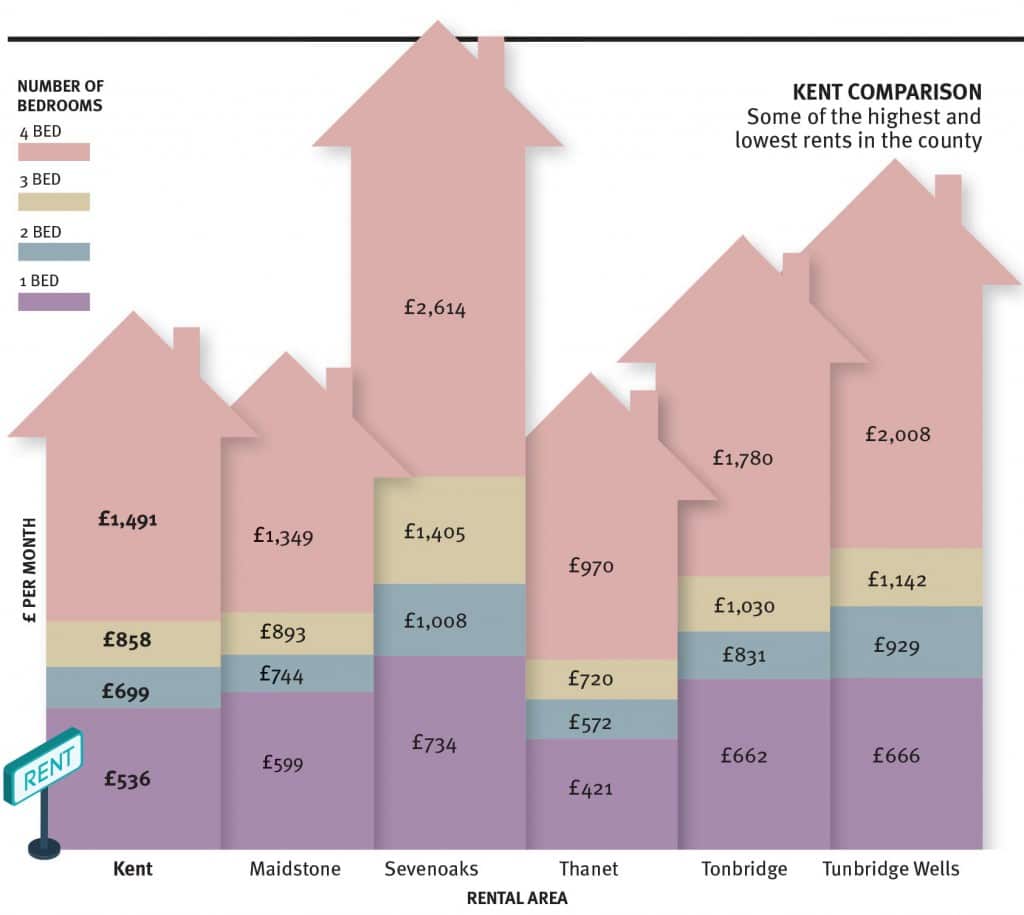

This ranges from £666 per month for a single-room flat to £2,008 for a four-bedroom house, compared to the Kent average of £536 and £1,491 respectively, but prices have risen further since then.

By comparison, rents in Tonbridge range from £662 for a one-room flat, to £1,780 for a four-bedroom house.

For Sevenoaks, the same sized dwellings are £734 per month and £2,614 per month respectively, however evidence suggests prices in all three towns has risen.

In total, the proportion of housing rented out by private landlords in Tunbridge Wells has increased from 11.24 per cent to 17.33 per cent over the past 20 years, slightly above the national average of 16.3 per cent.

Daniel Craw, of the pressure group Generation Rent, which campaigns for ‘affordable’ rates, said: “Rent in Tunbridge Wells might not be a problem if you can also afford a season ticket into London for a high-paid job.

“But if you work locally the high housing costs can make life a struggle and end any hopes of saving for a home of your own.”

FRIENDS WITH MORTGAGES ARE PAYING LESS THAN WE DO IN RENT

Bethan Minter (26) and her partner Shaun (29) currently rent a one-bedroom flat on Colebrook Road, near High Brooms, for ‘just shy’ of £700.

“It was one of the cheapest places we could find,” she explained, adding it actually represented ‘good value’ for money nowadays, as the flat itself was very nice and they got on well with the landlord.

But although they still aspire to own a home in Tunbridge Wells, where they were both ‘born and raised’, they are continuously playing catch up with rents, making saving for a deposit impossible.

“We work in Tunbridge Wells and would love to buy but can’t see it happening anytime soon and it’s hard to plan life goals,” said Ms Minter.

“We can’t afford to get married or have kids any time soon either.

“What is frustrating is that our friends who have managed to secure a deposit and are now on mortgages are paying less than what we pay in rent for something the equivalent size.”

Ms Minter, who works at Trinity Theatre as Youth Engagement Manager, said the friends of hers who did have mortgages had mainly benefitted from inheritance or parental help.

“Many others who are trying to save are opting to live at home with their parents. At the moment my sister has had to move back into the family home as she can no longer afford to rent.

“At least 80 per cent of my friends are in the same situation as us, while my mum likes to remind us that at my age she had two houses and two children.”

Although she doesn’t want to, Ms Minter and her partner have discussed potentially moving back in with one of their parents to save money.

And there is always the danger that even their current situation could soon become untenable.

“If this flat went back on the market at any time, there is definitely no way we could afford it. We would have to look further out. But our lives are here and we don’t want to leave.”

ONLY A HANDFUL OF OUR FRIENDS OWN THEIR OWN HOMES

Together with her fiancé Rory, Amelie Hawkins has been saving towards a deposit for a house for the past two years, since she moved back from London.

Ms Hawkins (30) said that while the lower rents of Tunbridge Wells meant she was able to save, it was not ‘a huge amount’ and much of it was taken up with travel costs.

“I have just renewed my train fare to London, which is £4,400 per year, and so saving has been a slow process although fortunately my partner does not have to pay for travel.

“When I used to rent in London, where I lived for two and a half years, I never even considered owning my own home.”

She said most of her peers in London have resigned themselves to a life of permanent renting; the thinking being that it was no longer possible to own your own home.

“Most of them just put that aspiration aside into the ‘impossible box’, and even in Tunbridge Wells it is only a handful of my friends who now own their home, and that has only occurred in the last couple of years.”

Ms Hawkins, who works in sports PR, is currently looking for a place to buy, aiming for somewhere within walking distance of the station.

“I need somewhere walkable because the hours I work are very long and with the added commute I don’t think I would be able to cope so I’m looking within a three-quartermile radius.

“But it is difficult to find what we want.”

One thing she is certain of, however, is that if her partner was not around to provide a second income, there would be little chance of her ever getting on the housing ladder.

“I simply wouldn’t be able to do it on my own,” she said.