IF ASKED where crowdfunding originated from, you may conjure up images of Silicon Valley startups filled with 20-something social media gurus.

But arguably it came from a small Tunbridge Wells [now Tonbridge] charity, Tree of Hope, who currently help around 900 families of children with a disability or illness raise the money for specialist care that is not freely available through the UK healthcare system.

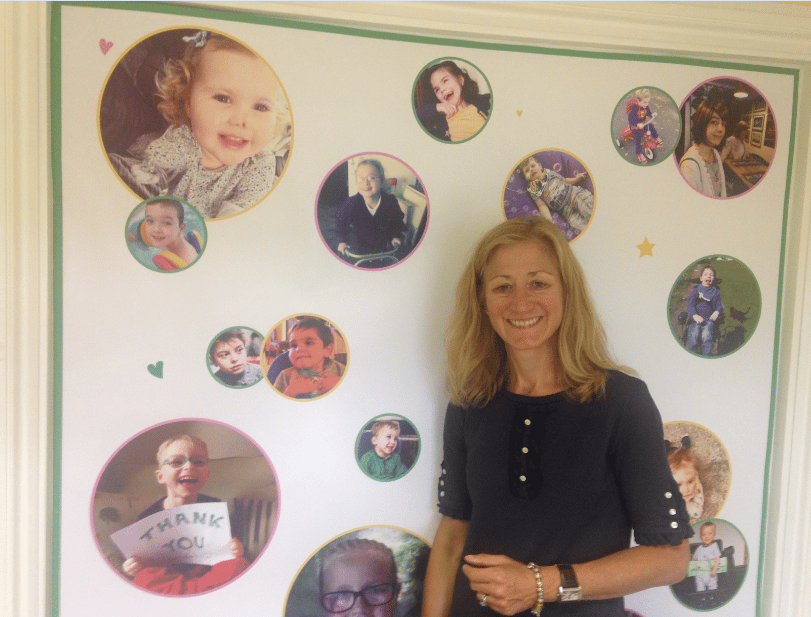

“The advent of social media and the internet helped us become a crowdfunder before crowdfunding ever started,” the charity’s CEO Gill Gibb told the Times. “We always say we are the children’s crowdfunding charity because that’s what we do.”

The phenomenon of crowdfunding, in which people appeal online to the entire globe for donations to a cause, has taken the world by storm in the last few years.

These causes can be anything from an entrepreneur looking for backing to an aspiring

poet needing to pay the bills while they write, as well as charitable endeavours.

In fact, according to sector analysts Charity Financials, crowdfunding will be worth more

than any one charity by 2019.

But while the ease with which people can canvass for cash has been liberating for many, it does come with its dangers, warned Ms Gibb. “A registered charity guarantees, through

detailed auditing and regulation by the Charity Commission, that donations will be put to use for the purposes they were originally intended.

“But go, for example, to JustGiving’s crowdfunding page, and it makes it clear that the site cannot guarantee donations will be used correctly. Or that the money will be used for

the reason given?

“I think that is a big problem. If you set up a crowdfunding page, then all that money could go straight into your bank account and you can do whatever you want with it.

“And while, of course, you wouldn’t, not everybody is like that. I’ve met many people since crowdfunding has become more prevalent, and because people have seen some of the frauds they are thinking twice about donating because they are starting to get more cynical that these people don’t exist. “We saw that after the terror attacks [where fake

pages were set up for victims] – that there were questions over how the sites were checking people were who they said they were.”

At Tree of Hope, they ensure they know where their money is going because they work with their families, who come from all over the UK, every step of the way through their journey, as well as demanding medical confirmation of the condition involved.

Take Kelly Turner, for example, a 17 year old who was diagnosed with Desmoplastic small round cell tumor [DSRCT], a rare form of cancer, two years ago.

Despite several rounds of chemotherapy at the Royal Marsden Cancer Charity hospital in

Chelsea, the tumours remained, and since they are close her liver, the hospital is not prepared to carry out any surgery.

The family sought a fifth medical opinion from the Memorial Sloan Kettering Cancer Center in New York, who agreed to do the surgery at an estimated cost of $1.2million.

So the Turners set upon the mammoth task of raising £1million, setting up their own online JustGiving page where people could donate.

But once they spoke to Tree of Hope, they soon realised the benefits of working with the charity rather than going it alone, especially when it came to taxation.

“If you donate through a registered charity, you can claim Gift Aid, which turns a pound into £1.25. Once we take fees, it is still £1.11,” explained Ms Gibb.

“If you are using JustGiving on your own, you still have fees to pay [6.25 per cent], which means you are getting less for your pound because you’re not attracting Gift Aid. Plus most corporates, trusts and foundations will only donate to a registered charity.

“Once we explained this to Kelly’s family, they realised they were missing out on a lot of

potential donors.”

Since switching from independent fundraising to Tree of Hope in October 2016, they have gained an additional £22,447 in Gift Aid – that’s money they wouldn’t have if they had stuck it out on their own, even with the identical amount of donations coming in.

“People were asking them: ‘Why did you switch? It was working’ and, yes, it was working, but not as well as it could have.

“With a massive target like theirs, every penny counts, and if their earlier donations had attracted Gift Aid, they would be closer to their target.”

– Fundraising for Kelly currently stands at £573,153.

WHAT IS GIFT AID?

– Gift Aid is an income tax relief designed to benefit

charities and Community Amateur Sports Clubs

[CASCs]. If you’re a UK taxpayer, Gift Aid increases

the value of your charity donations by 25 per cent

because the charity can reclaim the basic rate of

tax on your gift at no extra cost to you.

Charities don’t pay tax on most types of income,

which is why the tax paid on financial gifts to

charity can be claimed back.

It was introduced in the Finance Act 1990 for

donations given after October 1, 1990, but was

originally limited to cash gifts of £600 or more.

This threshold was reduced in April 2000, when

the policy was substantially revised and the

minimum donation limit was removed entirely.

“The problem with Gift Aid and tax relief is most

people might have heard of it but don’t really

understand it,” said Tree of Hope CEO Gill Gibb.

“And it does seem unreal that a hard-up Chancellor

is giving us an extra 25p on every pound, but he

is, and the value to the sector is between £800

and £900million. But the public are suspicious of

it because it does seem strange.”

LOUIS BISHOP

– Six-year-old Louis Bishop, from Crowborough,

has quadriplegic cerebral palsy.

His family have done a lot of fundraising within

their community for various intense therapies and

equipment to help Louis’s development so that he

can become more mobile.

With some of the money fundraised, they were able

to buy a lift that goes straight into his bedroom.

This has enabled Louis to be more independent

and included within family life.

JUSTGIVING

– The company was founded by Zarine Kharas and Anne-Marie

Huby in 2001. They remain the only directors of the company and

were paid a joint £442,724 last year.

The highest paid director was paid £219,000, up from £152,000

the previous year. In total, the company spent £9.2million on

wages last year.

In 2016, £443million was donated on the website,

equating to around £28million taken by the company

in fees – leading to just over £1million net profit for

the year.

More than £7.8million has been raised via the

website following the attacks in Manchester, London

Bridge and Westminster and the Grenfell Tower fire.

The latter catastrophe resulted in the website breaking

its one-day record for donations received, meaning they

will have received at least £390,000 in fees.

TREE OF HOPE ANNIVERSARY CELEBRATION

– Tree of Hope will be celebrating their 25th

anniversary in October. Celebrations for the charity

will start with a special lunch on Friday October 13

at The Spa Hotel in Tunbridge Wells.

It has just been announced that former Kent and

England Cricket Captain Chris Cowdrey will be in

attendance, as will John Taylor and Rob Andrew,

who are Lions Rugby personalities, along with a

number of other sporting legends.

There will be an opportunity to ask them questions

about their careers and to chat about the recent

Lions tour.

Tables are available at £750 or £1,000 with a Sports

Hero and seat ten people. Alternatively, you can

book a group of four for £300.

For further information, or to book, call 07846

740378 or email: sportingheroeslunch@gmail.com

www.treeofhope.org.uk